Criminals sometimes prey on SDIRA holders; encouraging them to open up accounts for the objective of earning fraudulent investments. They normally fool investors by telling them that In case the investment is accepted by a self-directed IRA custodian, it needs to be legit, which isn’t accurate. Yet again, Ensure that you do thorough homework on all investments you end up picking.

Often, the expenses connected with SDIRAs might be higher and more challenging than with a regular IRA. It's because with the increased complexity connected to administering the account.

You can easily pick an existing IRA custodian of the choice or if you don’t have one particular, Beagle is teaming up with leading IRA providers to offer you an industry-top minimal payment robo-advisory Answer to bring you a greater way to save lots of for retirement.

You ought to take into account all the factors that ought to be evaluated inside of a rollover conclusion including investment selections, costs, costs, penalties and account protections from legal and creditor dangers, and produce a comparison on your existing retirement account. You need to consult with together with your own money and tax advisor prior to making a rollover decision.

Usage of third party business logos will not indicate any affiliation with or endorsement by All those companies. Beagle Spend, LLC reserves the proper to limit or revoke any and all provides at any time.

Complexity and Accountability: By having an SDIRA, you have a lot more control around your investments, but You furthermore mght bear extra responsibility.

Be in control of how you improve your retirement portfolio by utilizing your specialized awareness and interests to invest in assets that in shape with the values. Received skills in real-estate or non-public fairness? Utilize it to help your retirement planning.

This contains comprehension IRS rules, managing investments, and staying away from prohibited advice transactions which could disqualify your IRA. A lack of knowledge could result in expensive errors.

We make clear the variances amongst two of the most common varieties of lifestyle insurance to assist you determine what can be right for you.

Homework: It truly is termed "self-directed" for the purpose. By having an SDIRA, you might be totally answerable for completely investigating and vetting investments.

Assume your friend could be starting off another Fb or Uber? Having an SDIRA, you can invest in leads to that you believe in; and likely appreciate greater returns.

An SDIRA custodian differs because they have the right personnel, skills, and capability to take care of custody with the alternative investments. The initial step in opening a self-directed IRA is to find a provider that is see page specialized in administering accounts for alternative investments.

All investments have risk, and no investment technique can assure a earnings or safeguard from loss of cash.

At Beagle, we had been Weary of how tricky it was to keep track of our old 401(k) accounts. We never ever understood where by all of them were, if they were being making funds or what why not look here charges we had been paying. That’s why we designed the simplest way to locate all of your current 401(k)s.

The tax strengths are what make SDIRAs desirable For a lot of. An SDIRA can be both of those classic or Roth - the account type you decide on will count mostly on the investment and tax method. Look at using your financial advisor or tax advisor in case you’re Doubtful which can be finest for you personally.

Registration being an investment adviser won't suggest a particular standard of ability or education, along with the information of this communication hasn't been authorised or verified by The us Securities and Trade Fee or by any state securities authority.

Higher Expenses: SDIRAs usually come with increased administrative expenses in comparison to other IRAs, as selected elements of the executive procedure can't be automatic.

Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Tiffany Trump Then & Now!

Tiffany Trump Then & Now! Erik von Detten Then & Now!

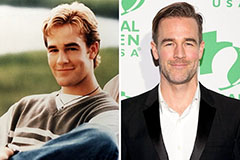

Erik von Detten Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!